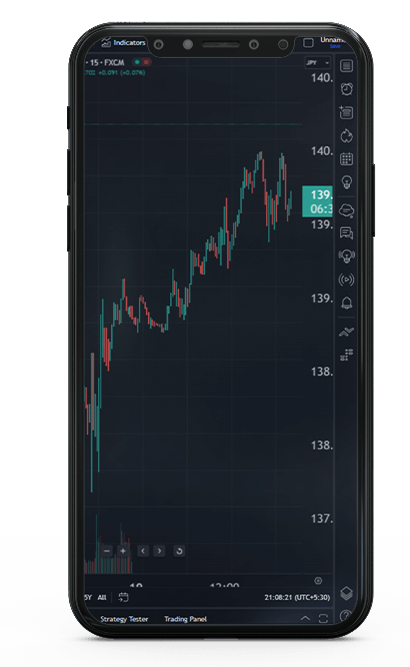

Trade 40 currency pairs including major, minor and crosses with ultra-low spreads and immediate execution. View the minimum spreads, margin rates and trading hours for our most popularly traded FX pairs in the table.

- Ground floor, The South Bay Building, Rodney Bay, Gross-Islet Saint Lucia, P.O. box 838, Castries, Saint Lucia.